Can you Predict How Long You Are Going to Live? It could be much longer than you think.

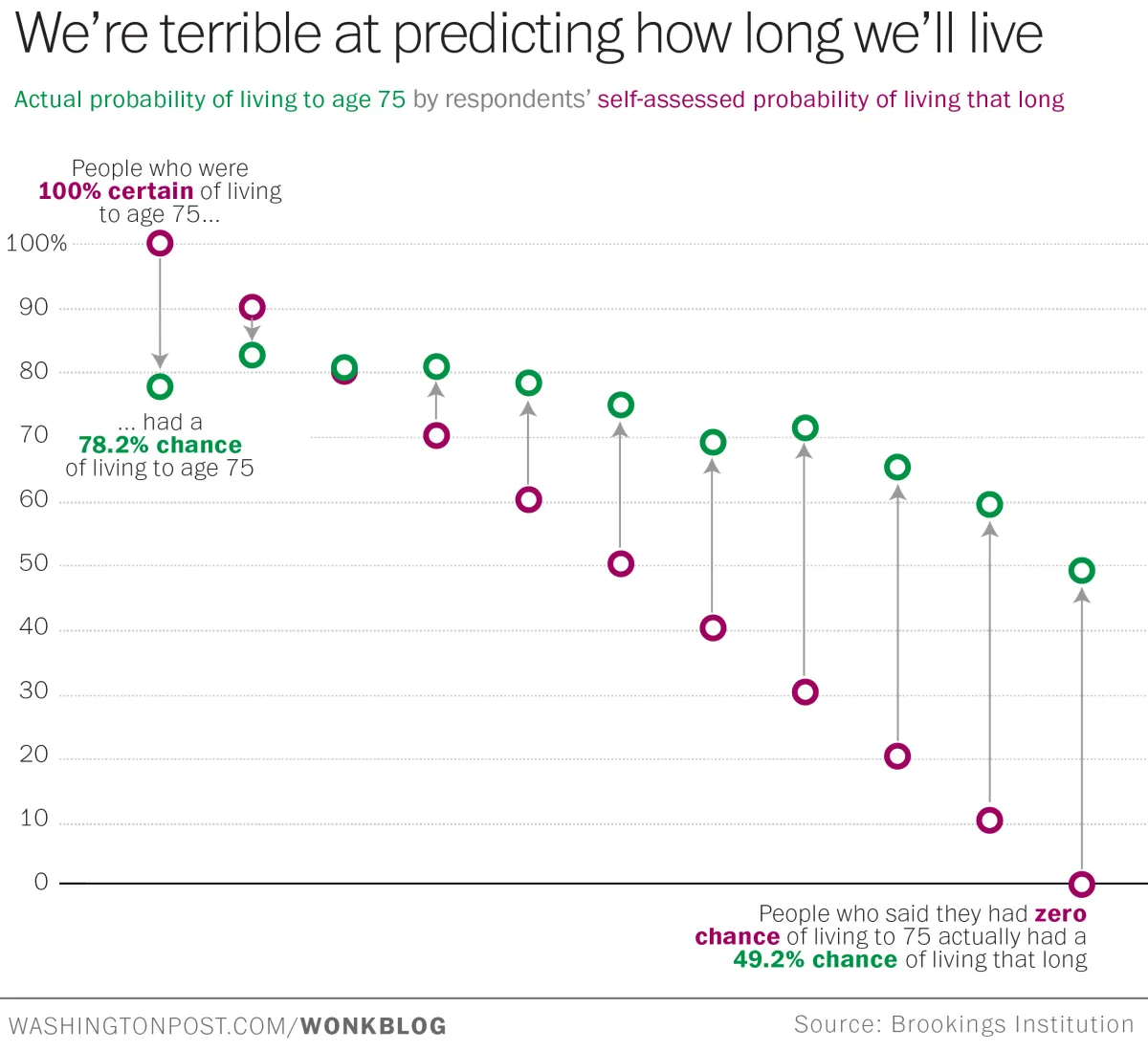

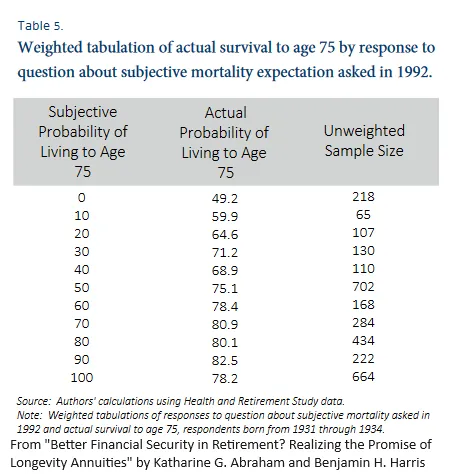

In 1992, Americans ranging from age 51 to 61 were asked to estimate

their chances of living to age 75. Researchers later checked to see how

well the older members of that survey — those born from 1931 to 1934 —

had done it predicting their chances of living to age 75. It turns out

many people drastically underestimated their chances of living to age

75. As you can see from the graph and the table below, people who

believed that they had a 0% chance of living to age 75 actually had a

49.2% chance of living to age 75. Although there were some exceptions,

the overall trend was that people were more likely to underestimate

their chances than to overestimate them.

Source: "You’ll probably live much longer than you think you will" by Christopher Ingraham

CONGRATULATIONS! YOU'VE TAKEN A BIG STEP TOWARDS protecting your loved ones!

Source: “Better Financial Security in Retirement? Realizing the Promise of Longevity Annuities” by Katharine G. Abraham and Benjamin H. Harris.

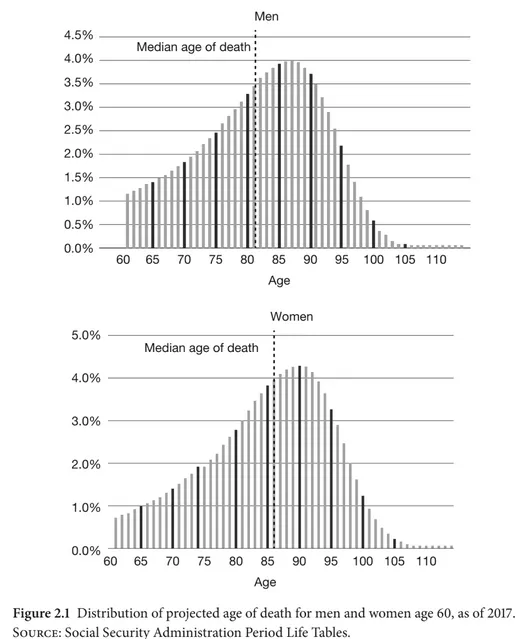

Many people are living far longer than age 75. As you can see from these graphs, as of 2017 these are the distributions of projected ages of death for American men and women currently age 60 (or age 60 as of 2017). When we think of our life expectancy, we normally think in terms of an average or median for someone in our age and risk class. However as you can see from the graphs below, people typically do not go through their lives as statistical medians or statistical averages. On the one hand, many people are living significantly less long than their median life expectancy and on the other hand, many people are living far longer. Furthermore conventional retirement planning frequently starts at age 65 and only plans for a 30-year retirement. If someone retired at 65, that would mean that their funds might run out by the time they are 95. However, as we can see from the charts below, a statistically significant number of people are living significantly past age 95.

Source: The Retirement Challenge: What’s Wrong with America’s System and A Sensible Way to Fix It by Martin Neil Baily and Benjamin H. Harris.

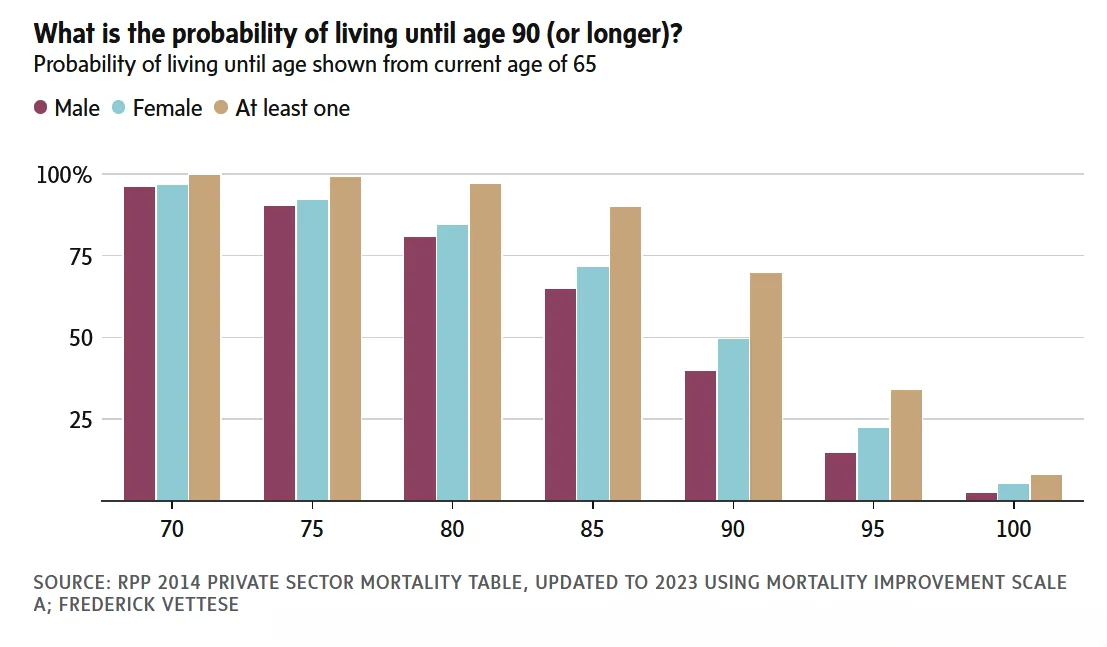

So what is your probability of living until age 90 or longer if, for example, you are currently age 65? The data below is actually from Canada; however I believe Canada has similar life expectancy statistics to the United States, so this should still be fairly relevant to those of us in the United States. Anyway, many Canadians are living to age 90, 95, or even 100, and for a Canadian couple, the combined chance that at least one of them will live to age 90, 95, or 100 is quite significant. In the case of a Canadian couple who are both aged 65, there is a 34% chance that at least one of them will live to age 95 and an 8% chance that at least one of them will live to 100. If you are not taking this into account when planning for retirement or whatever you wish to do during the later years of your life, you’re not really planning for maintaining an income for what could be your lifespan.

From “What is your probability of living past 90? The answer could change your retirement planning” by Frederick Vettese in The Globe and Mail.

You may have noticed from the 2017 Social Security life expectancy projections that some people are living well past 100. As of June 16, 2024, the world record for the oldest person to ever live and have her age verified by the Guinness World Record records is Jean Calment, who died at 122 years and 164 days. However, that world record could change any time. Marcelino Abad Tolentino of Peru claims to have turned 124 on April 5th, 2024 and is currently trying to get verified by the Guinness World Records.

From “Oldest person ever: 122-year-old Jeanne Calment’s extraordinary life” by Sanj Atwa on Guiness World Records.

From “Marcelino Abad Tolentino” on Gerontology Wiki.

One way to financially plan for longevity is with longevity insurance, also called lifetime income, also called lifetime income annuities. The most common form of lifetime income in the USA is called Social Security, and nearly everyone in the USA will claim Social Security in the later years of their life, normally starting in their 60s or 70s. Another popular sort of lifetime income is to get a pension from an employer who offers them. (Unfortunately, there have been some scandals with some employers not properly funding their pension plans.) Finally, if someone wants more lifetime income than what they can get from Social Security and/or pensions, another option is to go to a reputable insurance company, preferably one that's been around for over 100 years, and trade a lump sum of money in exchange for a guaranteed income for life, backed by the claims-paying ability of the insurance company.

Disclaimer: We are not medical professionals and the following is not medical advise, just statistical analysis.

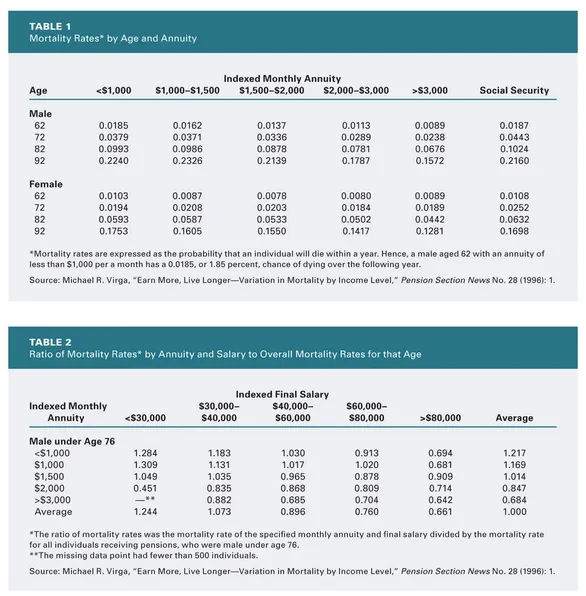

Where this gets really interesting is that having a lifetime income annuity is apparently correlated with increased longevity. One possible reason is that people with cancer are probably much less likely to buy annuities, whereas healthy people who expect to live longer are more likely to buy them. However, to remove that sort of selection as a variable, researchers looked at data from the Civil Service Retirement System (CSRS), "a defined-benefit plan for federal employees that pays a lifetime annuity to retirees based on their years of service, among other factors." You can see some of the data below.

According to Patrick C. Tricker, "Table 1 generally shows mortality rates decreasing as the amount of the monthly annuity payments increase. Table 2 shows that this trend holds even when the data are divided up based on final salary. Some exceptions to this trend exist, but these deviations appear to result from natural statistical variation."

Tricker continues, "In some cases, the differences in mortality rates are highly significant. For instance, among retired individuals under age 76 whose final salary was between $40,000 and $60,000, those individuals with a monthly annuity of above $3,000 had a mortality rate 33 percent lower than the average individual of the same age and final salary range who received an annuity of less than $1,000 per month. Final salary is not a perfect proxy for wealth and income, but it is a strong one. Hence, these results suggest that the incentive effects of a life annuity increase the life expectancy of the annuity’s owner."

Source: "Annuities and Moral Hazard: Can Longevity Insurance Increase Longevity?" by Patrick C. Tricker

Tricker is essentially arguing that having a lifetime income annuity, especially a high-paying one, may increase incentives for people to engage in healthy habits, not to mention their ability to afford healthy habits, thereby reducing the risk of dying in any given year.

Fortunately, it's possible to trade a lump sum for a guaranteed income for life, even if you live to be 120.

You can even guarantee that if you don't live very long, your heirs receive what you paid minus what you receive.

One of our Insurance Specialists will be in touch soon to go over your Custom Burial Insurance Plan so you can start protecting your loved ones as fast as possible!

In the meantime, if you have specific questions right now and would live to speak with an insurance specialist immediately, click the button below to open Facebook Messenger to being a live chat!

Tricolored Heron Agency

helping protect families

TERMS & CONDITIONS | PRIVACY POLICY | LEGAL

All Rights Reserved 2020 © Copyright